Medicare Basics Explained

Understanding your Medicare options and when and how to enroll

Medicare provides affordable health care insurance for more than 64 million Americans. While a clear benefit for older adults, understanding how it works and how to enroll can be daunting, and it can take a bit of time and effort to navigate the process.

As a Harvard Medical School affiliated provider of health care for seniors, Hebrew SeniorLife knows a thing or two about Medicare and we’re ready to share it with you!

What is Medicare and Who is Eligible?

Run by the Centers for Medicare and Medicaid, Medicare is a federal health insurance program for people aged 65 and older and younger people with certain disabilities. Medicare helps pay for hospital stays, medical services, and some prescription drugs and is available to everyone who has worked, met payroll taxes, and contributed their share to Social Security, regardless of their wealth at retirement. Medical bills are paid from trust funds, which those covered have paid into throughout their life in the workforce.

What is referred to as Original Medicare has two basic parts, Part A (hospital insurance) and Part B (medical insurance). There is also an option sometimes referred to as Part C, which refers to Medicare Advantage plans. These plans are offered by Medicare-approved private companies that must follow rules set by Medicare. They also often include Part D (drug coverage), which must be purchased separately from Parts A and B under Original Medicare. Don’t worry, we’ll explain drug coverage in a minute.

There is no cost for Part A for most people, but Medicare recipients pay a quarterly premium for Part B and are also responsible for costs that exceed what Medicare reimburses providers for procedures and services. So, it’s important to understand that Medicare Part A and Part B helps pay, but doesn’t cover health care costs completely. Your co-pays will depend on the plan you choose, but more about that later.

What Medicare Part A Covers

Part A helps cover:

- Inpatient hospital care

- Skilled nursing facility care

- Hospice care

- Home health care (in certain circumstances after you are in a hospital or skilled nursing facility)

What Medicare Part B Covers

Part B helps cover:

- Services from doctors and other health care providers

- Outpatient care

- Home health care (if you are homebound and need skilled care)

- Durable medical equipment (like wheelchairs, walkers, hospital beds, and other equipment)

- Drugs that usually aren’t self-administered, but rather given by a doctor or other health care professional in a hospital, doctor’s office, other outpatient facility, or at home by a home health aide or caregiver. These drugs are generally administered by infusion or injection. This gets a bit complicated for the average lay person to understand, so if you’re concerned about what kinds of drugs are covered by Original Medicare Part B, you can go to the Medicare website or talk to someone at one of the resources listed at the end of this blog.

- Fully covered vaccinations include COVID-19, influenza (flu), pneumococcal (pneumonia), and often hepatitis B.

Medicare Advantage Explained

There are a number of Medicare Advantage plans, also known as Medicare Part C, proliferating in the health care insurance marketplace these days. Some are better than others, and there are pros and cons to going with this option.

These plans bundle Part A and B coverage and, depending on the plan you chose, you will pay a premium on top of your Medicare premium. However, if you’re relatively healthy there are plans that will cost you only a few dollars more than you would pay with Original Medicare.

You’ll find that with Medicare Advantage plans, the more you pay, the more you get. All Medicare Advantage plans cap your yearly out-of-pocket expenses, whereas Original Medicare does not – a definite plus, and the cap shrinks with the more costly plans. Still the higher price may be well worth the investment if you have a health condition that puts you at a high risk for hospitalization, surgery, or extensive treatments such as chemotherapy for cancer.

One of the down sides to Medicare Advantage plans is that many require your doctors to practice within a specific network. So, if you already have a relationship that you want to keep with an out-of-network provider this could be a deal breaker and you may want to consider Medigap, which we’ll discuss below.

Good Medicare Advantage plans come with perks not offered by Original Medicare, including fitness programs and some vision, hearing, and dental services. Some plans may offer coverage for services like transportation to doctor visits, over-the-counter drugs, and services that promote your health and wellness.

Plans can also tailor their benefit packages to certain chronically ill enrollees. These packages will provide benefits customized to treat specific conditions. Check with the plan before you enroll to see what benefits it offers, if you might qualify, and if there are any limitations.

You can view a chart that compares Original Medicare with Medicare Advantage plans on the government’s Medicare website.

Medicare Part D

Other drugs that are prescribed by your doctor and then filled at a pharmacy (or delivered to your home) and are self-administered may be covered by a separate Part D plan. These can include both oral and injectable drugs. You must have Medicare Part A and Medicare Part B to join a separate Medicare drug plan.

When you enroll in a Medicare Part D plan, you pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier’s network of pharmacies to purchase your prescription medications. Instead of paying full price, you will pay a copay or percentage of the drug’s cost. The insurance company will pay the rest.

Medigap

Then there is Medigap, which is Medicare supplemental insurance. The difference between Medicare Advantage and Medigap is the way they work.

Medigap is intended simply to cover some of the gaps (also known as cost-sharing) that Original Medicare doesn’t pay for — coinsurance, copayments, and deductibles, for instance. Original Medicare only pays 80 percent for Medicare-covered services such as doctors’ services and outpatient medical services and supplies.

Also, as pointed out earlier, you may have fewer choices in terms of doctors and health care providers in some cases with Medicare Advantage plans. With Medigap, you have access to any doctor or provider who accepts Medicare. Be aware that legally, you can’t have Medigap coverage with a Medicare Advantage plan. However, you may be able to switch between the two plans if a change in your health status makes Medigap the better choice.

How Does Medicare Decide What to Cover?

Medicare pays claims for services or procedures if they’re deemed “medically necessary.” (This means a face-lift is on you.) To qualify, health care services or supplies must meet the following criteria:

- they are needed to diagnose or treat an illness or injury, condition, disease, or its symptoms; and

- they meet accepted medical standards.

Medicare determines a base rate for a specified unit of service, and then makes adjustments based on patients' clinical severity, selected policies, and geographic market area differences. Optimally the process of providing a service and receiving approval from Medicare appears seamless to the patient, but be aware that sometimes there can be a lag between a doctor’s order and approval if you’re hospitalized or receiving treatment for a condition for the first time. Don’t be alarmed – it all works out eventually.

Although you should be confident that Medicare will help cover all of your necessary health care needs, a variety of circumstances may trigger a claim denial. Sometimes the problem is purely administrative, such as incorrect coding of the procedure or service. You can always question a denial through an appeals process.

What Doesn’t Medicare Cover?

There are some services Medicare simply doesn’t cover. Still, Medicare may cover some normally ineligible services if they are proven to be necessary to treat a medical condition. For instance, it may cover a dental exam if you are about to undergo an organ transplant.

Original Medicare (Parts A & B) doesn’t cover:

- Routine dental exams, most dental care, or dentures

- Routine eye exams, eyeglasses, or contacts

- Hearing aids or related exams or services

- Most care while traveling outside the United States

- Help with bathing, dressing, eating, etc. (custodial or private care)

- Comfort items such as a hospital phone, TV, or private room

- Long-term care

- Cosmetic surgery

- Most chiropractic services

- Acupuncture or other alternative treatments

- Routine foot care

Some of these services may be covered by certain Medicare Advantage plans or supplemental insurance, which I’ll explain later.

How and When Do I Enroll in Medicare?

At first glance, signing up for Medicare seems fraught with technicalities. Understanding how, when, and where can overwhelm the best of us. But hang in there while we break it all down. And as is often the case, doing your research sooner than later is sound advice. Waiting until you turn 65 to figure it all out can cause costly mistakes. Sometimes timing is everything.

If you’re already receiving Social Security benefits or plan to start collecting once you turn 65, you’re all set. You will be automatically enrolled in both Medicare Part A and B and the cost of your premium will be deducted from your Social Security benefit. Otherwise, you can enroll online or in person with your local Social Security office.

If you opt for a Medicare Advantage plan you will also work with a representative from your selected plan or an insurance broker who will walk you through the process.

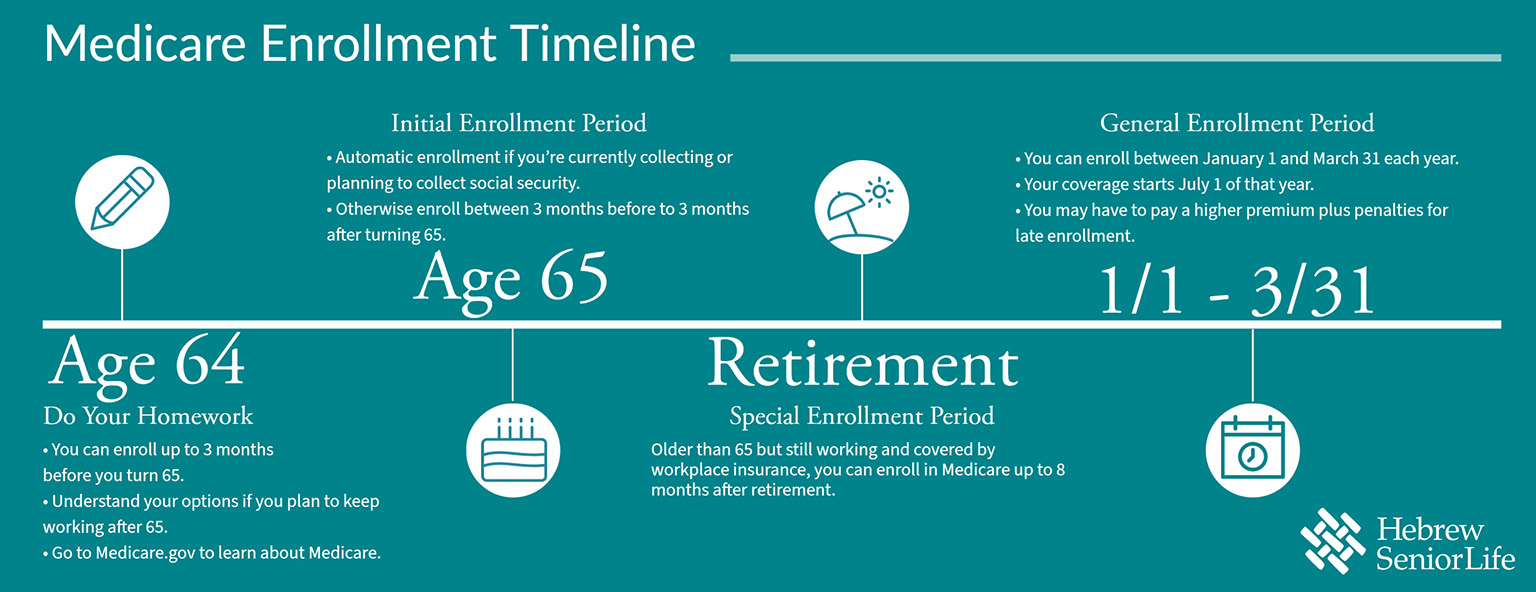

Understanding the Enrollment Periods

Initial Enrollment Period

So, let’s try and keep it simple. If you’re not automatically enrolled in Medicare through Social Security, you can sign up for Part A and/or Part B during the seven-month period that begins three months before and ends three months after the month you turn 65. This is referred to as the initial enrollment period.

Special Enrollment Period

These days more and more older adults are still working at 65, receiving health insurance through their employer, and delaying Social Security. If that’s your case, then you don’t have to enroll in Medicare yet. Keep in mind though that it can still often pay to enroll in Medicare Part A once you turn 65 even if you have health coverage through work. It won’t cost you anything, and this way, Medicare can serve as your secondary insurance and potentially pick up the tab for anything your work health plan doesn’t cover.

But here too, there is an exception, and that’s if your work plan involves contributing to a Health Savings Account. Medicare enrollees aren’t allowed to contribute to an HSA.

So, if you’re covered by an employer-sponsored group health plan through a current job or your spouse’s, you’re eligible for the special enrollment period, which lasts eight months after you stop receiving workplace health insurance benefits.

A word of caution - most people don’t owe a premium for Part A since they have been contributing to the trust funds mentioned earlier throughout their work life. So, you may figure that Part A will cover unforeseen hospitalization, and if you’re healthy – why not skip the premium for Part B and take your chances that you’ll just pay out of pocket for that yearly physical – right? Wrong – be forewarned that it’s a mistake to delay enrollment in Part B. If you postpone enrollment and aren’t covered by a work plan you will owe a 10% Part B late-enrollment penalty for every year you delay signing up.

General Enrollment Period

If you missed the initial enrollment period and don’t qualify for the special enrollment period, you can still enroll during the general enrollment period between January 1 and March 31 each year. And once again I need to stress that this option might cost you. Your coverage won’t start until July 1 of that year, and you may have to pay a higher Part A and/or Part B premium plus penalties for late enrollment.

We know the enrollment timeline can be confusing, so here’s a handy chart summarizing the to dos of signing up for Medicare. Bookmark it so you can refer back!

What If I Want to Keep My Private Insurance?

For those age 65 and older or who have a qualifying disability, the Medicare program is the cheapest health insurance with the best benefits. And, if you qualify for premium-free Medicare Part A, and most of you do, why wouldn’t you take it? You can only opt out of Part A if you forfeit your Social Security benefit. And as explained earlier if you don’t enroll in Part B within your initial or special enrollment periods you will pay a penalty if you decide to enroll later.

The only instances where someone 65 or older is ineligible for Medicare is if they haven’t worked for 40 quarters at a job covered by Social Security/Medicare or don’t qualify through the work history of a current, former, or deceased spouse.

Many older adults supplement Medicare with plans that work with the Medicare system to pay for costs not covered by Medicare. In this case Medicare remains the primary payor and the supplemental insurance will cover most or all of the rest depending on the plan.

All that said, here’s another reason for investigating what enrolling in Medicare will mean for you. You’ll probably be pleasantly surprised to learn that your providers and/or preferred hospital all take Medicare and nothing will change in terms of your health care experience.

And finally, there are more options available if Original Medicare won’t provide enough coverage for your situation.

Medicare vs Medicaid – What’s the Difference?

People often confuse Medicare with Medicaid. Medicaid is a no- or low-cost assistance program for income-eligible patients at any age. It is run by state and local governments within federal guidelines, and provides coverage for low-income individuals who can’t afford Medicare premiums and copays. In Massachusetts, the Medicaid program is known as MassHealth.

In some cases, individuals may fall into a category known as dually-eligible, which is a term used to describe Medicare beneficiaries who receive financial assistance for certain Medicare costs from their state Medicaid program. These individuals don't qualify for full Medicaid benefits from their state, like long-term services and supports or behavioral health services.

Resources to Help With Medicare Enrollment

There certainly is a lot to digest! But don’t despair. There is a wealth of information on the government’s Medicare website. And, there are also in-person resources where an expert can walk you through the process, help you develop an action timeline, and determine the best plan for you. Massachusetts residents can contact the following organizations:

- The Massachusetts SHINE Program provides free health insurance information, counseling, and assistance relating to Medicare. To reach your local SHINE office, call 1-800-243-4636.

- HealthInsurance.org provides an opportunity to explore and compare options.

Medicare Providers in the Boston Area

Hebrew SeniorLife, a Harvard Medical School affiliate, offers a full continuum of Medicare-covered health care services. This includes inpatient skilled nursing, outpatient physical and occupational therapies, and outpatient memory care and diagnosis at Hebrew Rehabilitation Center in Boston and Dedham; plus home health and hospice care in homes in the Greater Boston area. Because we focus exclusively on geriatric care, you can trust that our services are tailored to the specific needs of older adults. Learn more about how our health care services can support you at any stage in life’s journey, or contact us today if you have questions about what’s included with your Medicare coverage.

Blog Topics

Learn More

The Best Health Care for Seniors

Hebrew SeniorLife is the only senior health care organization affiliated with Harvard Medical School. Members of our caregiving teams specialize in providing geriatric care, and they do so with care and compassion.